It’s good to be as close as possible to the ones who can always bring out the best in you! 🙂

(18) Subscribe

Banking is one of the money industry. People who succeed in this area are usually very focussed on their targets.

Dealing with checks is going to be one of your responsibilities if you become a teller. The checks have all kinds of shapes and colors, but the important features are almost the same. Usually the name of the person who owns the check comes first.

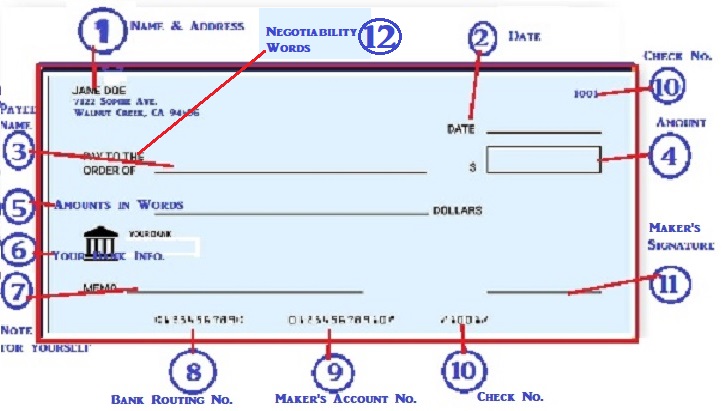

In points from 1 to 12, this sketch for a check clarifies how the check negotiability works:

- The name of the check maker and address or without address.

- If the date on the check is older than 6 months, some banks do not accept. Also if the date is in the future, it is up to your supervisor if she will approve it.

- The payee name but it is also acceptable to write that the check is made for “Bearer” or “Cash”.

- The Numerical amount in the check, which has to agree with the written amount. However, the written amount is the legal amount on the check.

- The amount in words (the written amount).

- The check maker bank info must appear on the face of the check.

- Notes for the maker of the check as a reminder of what the check was written for. It could be left empty.

- The routing number of the drawee bank.

- The account number of the check maker.

- The check number.

- The signature of the check maker.

- The words of “Pay to Bearer” or “Pay to the order of” must appear on the check. This is known as the negotiability words.

Pls don’t hesitate to ask questions or to send suggestions.

Until we chat again, think and practice with our hugs and kisses ❤