Sometimes with your busy mind, you can hardly see whoever you’re talking to! 🙂

(19) Subscribe (this link will be only used for additional special posts that will only apprear for interested participants)

Banking covers dealing with money, its management, and its investment.

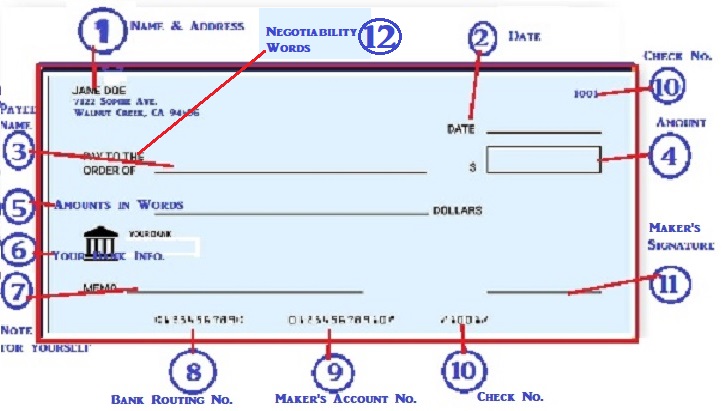

As an associate or a teller in the bank or in the financial entity you work with, as it is mentioned before, the checks are important to be understood, studied, and all its rules must be applicable to your transactions that include checks.

As it was introduced to you, there is a number of points in each check that you need to pay a good attention to it, and if you were hesitant for any reason, you should consult with your superior.

One of these points is the routing no. or the MICR line which is consisted of 9 numbers only and each number represents one fact about the check. The first four digits is broken down as the first two identifies the bank’s type and its Fed Reserve District. The next two identifiers represent the Fed Reserve branch within the district and will be used for check processing.

Still there is more for next time.

Until we chat again, think and practice with our hugs and kisses ❤